Fraud Benchmark 2024: Did you know…? Part II

By Katherine Beaty, TEZ Technology

Last week in Part I of our latest blog series, the significant toll that fraud takes on organizations across all sectors was discussed, including parking and transportation. The piece examined the financial impacts, red flags organizations can look for, and the individuals most likely to commit fraud.

In Part II of the series, learn the strategies for preventing and responding to fraud to protect yourself and your organization.

Responding to Fraud

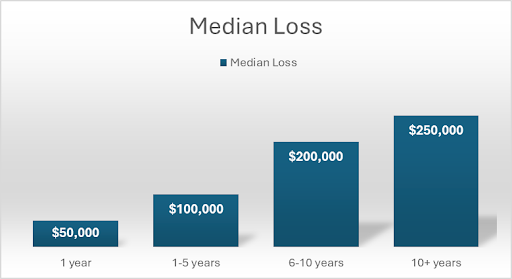

Did you know that the longer a perpetrator has worked for an organization, the more costly their frauds tend to be? Here's a breakdown of median loss based on tenure with the organization:

Several factors influence how an organization responds to discovered fraud. Whether they opt for internal discipline or external legal action depends on the perpetrator's role, the type of scheme, and the amount of the losses. For instance, owners/executives are least likely to be punished for fraud, while staff-level employees are most likely to be terminated. In 57% of cases that resulted in criminal referral, asset misappropriation schemes were the most referred and had the highest success rate without the need for a trial.

Preventing Fraud

Did you know that organizations that have anti-fraud controls are associated with lower fraud losses and faster fraud detection? More than half the organizational frauds occurred due to a lack of internal controls or an override of existing internal controls. This is not a time to turn on “autopilot” and take your hands off the wheel. As a result of taking their hands off the wheel, 82% of victim organizations modified their anti-fraud controls. Here are sample control modifications some organizations made:

- Management Review

- Proactive data monitoring/analysis

- Surprise audits.

- Fraud training for employees

- Fraud training for managers/executives

Take Action

The key takeaway is to TAKE ACTION and remember to be proactive to your fraud prevention and not reactive.

The findings from the 2024 ACFE Report to the Nations underscore the significant impact of occupational fraud on organizations across all sectors, including parking and transportation. By understanding the various types of fraud, how they are detected, and who commits them, organizations can better prepare and protect themselves.

It's clear that fraud detection and prevention require a multifaceted approach. Implementing robust internal controls, fostering a culture of integrity, providing regular fraud detection training, and enhancing reporting mechanisms are essential steps. Organizations should also pay close attention to red flags and demographic characteristics associated with higher fraud risks.

Moreover, the financial impact of fraud is substantial, with median losses escalating significantly based on the perpetrator’s tenure and position within the company. This highlights the need for vigilant oversight and the importance of periodic reviews and surprise audits.

Organizations that proactively address these issues and continuously improve their anti-fraud measures will not only mitigate losses but also contribute to a healthier, more transparent business environment. Remember, preventing fraud is not a one-time effort but an ongoing commitment to maintaining ethical standards and robust internal controls.

By taking decisive action and leveraging the insights such as those that are gained from the ACFE report, your organization can stay ahead of fraud risks, ensuring financial integrity and fostering trust among stakeholders.

TEZ is committed to developing and implementing innovative parking solutions designed to help eliminate opportunities for fraud in parking operations. Visit www.teztechnology.com to learn more about our valet and self-parking solutions.

Reference:

For more details and to access the full report, visit the ACFE Report to the Nations at www.ACFE.com/RTTN.